Beer Nation Germany? Reluctance regarding demand for premium beer

SINUS survey to mark International Beer Day (August 4th)

Germany is known for its breweries and their beer. However, the high energy and raw material prices are causing distress for many brewers. On the occasion of the International Beer Day, SINUS-Institut and OPINION got to the bottom of the target group perspective: Who spends more money than average on beer in Germany? How does beer compare to other product categories? And where does Germany stand in international comparison? Answers to these questions are provided by representative data from the SINUS Institute.

Price awareness and trend towards non-alcoholic beverages - beer under pressure in Germany

Only few Germans spend an above-average amount of money on beer. This is shown by a representative survey on willingness to spend for a total of 27 product categories and services.

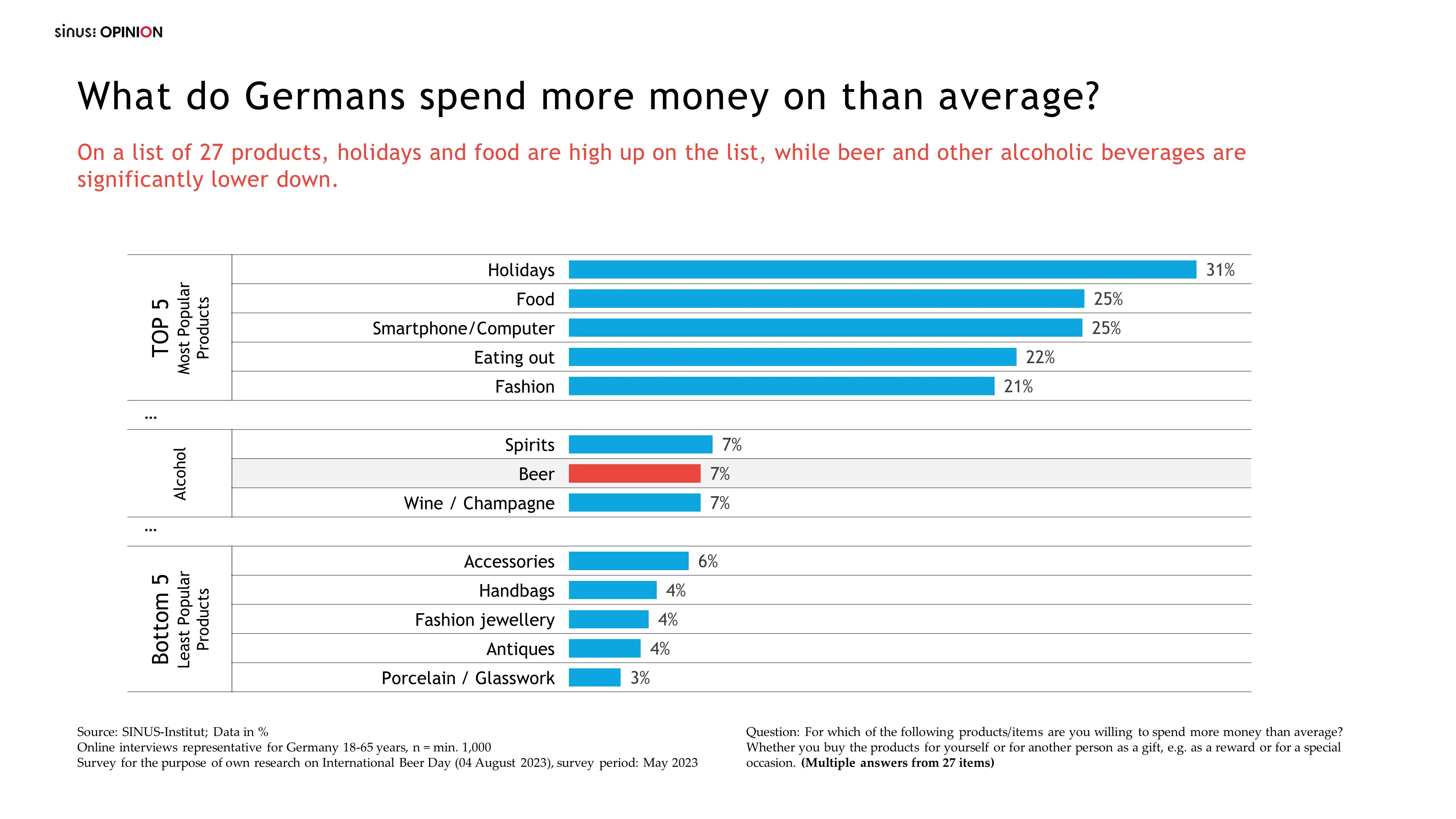

According to the survey, only 7% of respondents feel that they spend an above-average amount of money on beer, which puts this alcoholic beverage on position 19 out of 27 products. This means that only few respondents perceive their expenses for beer to be significantly different from those of their environment. In general, Germans´ demand for premium alcoholic beverages is not overly high, with wine (6%) and premium spirits like whiskey (7%) scoring similarly low. On the other hand, the greatest willingness to spend more is for holidays (31%), food for everyday consumption (25%), electrical appliances such as PCs or smartphones (25%), restaurant visits (22%) and fashion (21%).

Possible reasons are explained by Thomas Maurer, CEO of the SINUS partner OPINION: "We also see consumer restraint or a lack of willingness to spend in other beverage and food categories. Consumers are clearly more price-conscious, consider their purchases more carefully, buy less spontaneously and pay more attention to discount offers. The beer market in particular is under pressure from two sides: on the one hand, the price increases and, on the other, the general consumption trend in Germany towards non-alcoholic soft drinks, which can only be partially compensated for by non-alcoholic beers."

Beer has a higher value in conservative middle-class milieus

But who values beer more? Men show a higher willingness to spend than women (men: 9% vs. women: 4%), as do respondents with low incomes (12%). Age differences are only slightly distinctive.

Decades of research by SINUS-Institut show that consumer attitudes are strongly influenced by values and lifestyles. Thus, the willingness to overpay differs predominantly based on lifestyles, which is confirmed by the analysis according to the Sinus-Milieus. The Sinus-Milieu approach groups people in Germany into ten "groups of like-minded people" based on their values, lifestyles and social situation.

Manfred Tautscher, Managing Director of SINUS-Institut, explains: "The data reveal that in Germany, conservative and middle-class milieus in particular show an above-average willingness to spend more money on beer. Thus, it is the Conservative Upscale Milieu and the Nostalgic Middle Class Milieu for whom beer is a particularly valued product and who are willing to pay a premium price for it."

In an international comparison: The value of beer in Germany is comparatively low

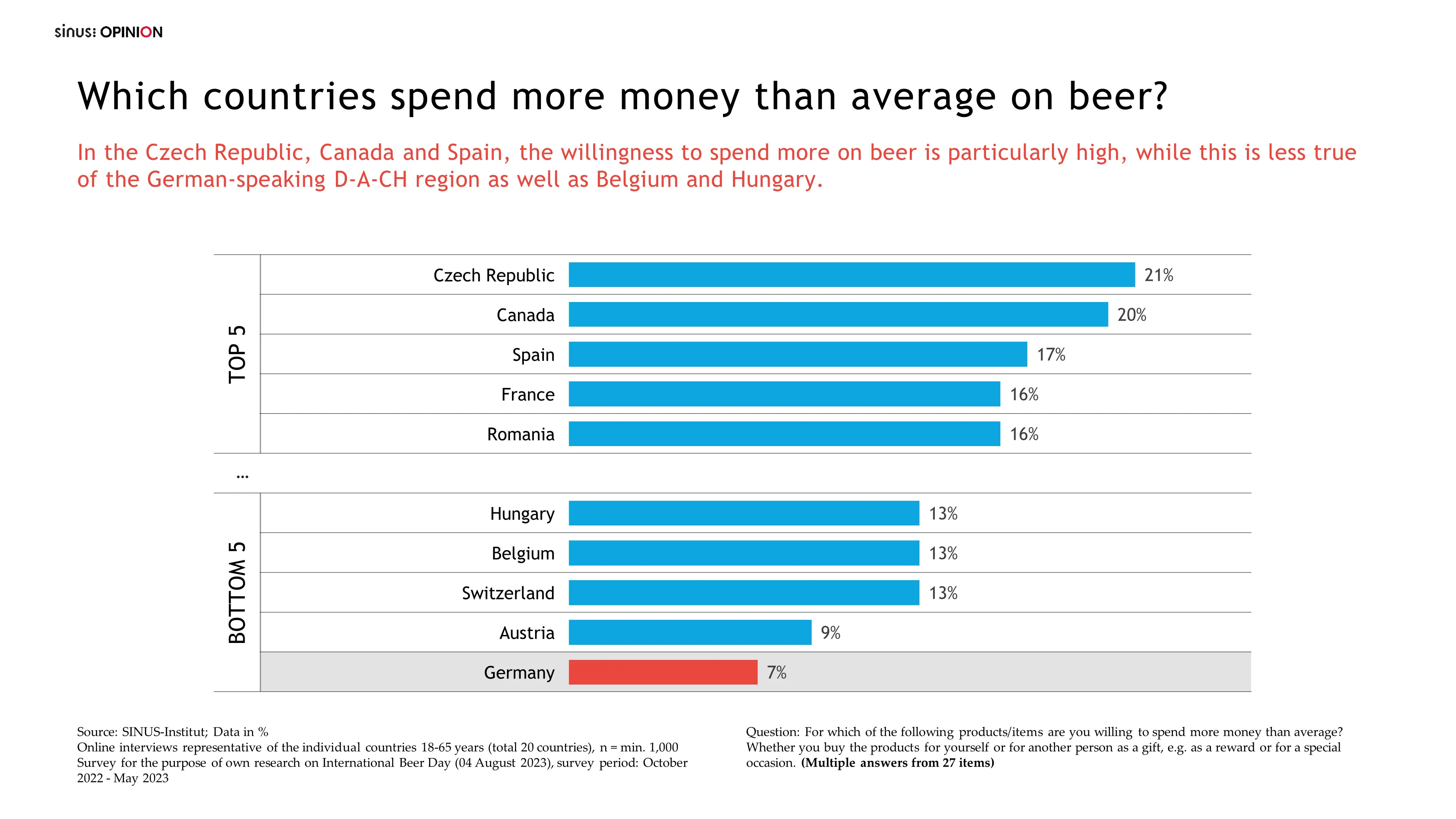

Germans seem to consider their beer sacred, and the population is correspondingly price-sensitive. In other markets, the willingness to spend above-average amounts of money on beer is significantly higher. In the Czech Republic (21%), Canada (20%), Spain (17%) and France (16%), for example, premium prices for beer are met with greater acceptance. However, this reluctance is not a purely German phenomenon: the premium demand is significantly lower in all German-speaking countries (Germany: 7%, Austria: 9%, Switzerland: 13%).

Significant country differences: beer as a national beverage vs. beer as a beverage of the modern elite

Country specifics become even clearer when the results are analysed in the international social model of the Sinus-Meta-Milieus, which identifies "groups of like-minded people" across national borders. The Sinus Meta Milieus analyse internationally comparable patterns in value orientations, lifestyles and consumption preferences. It can be observed that people from different countries, but from comparable milieus, have more in common with each other than with the rest of their compatriots.

“This can also be confirmed with regard to consumption, because the consumption behaviour of people from the same milieus is similar internationally, especially when it comes to expectations of products and brands. When it comes to food and beverages, however, cultural aspects play a far greater role. This is particularly evident in the status of beer, which appeals to very different target groups in different countries," Manfred Tautscher explains. "While in countries like Germany, Austria or the Czech Republic beer is considered a traditional after-work drink in the middle of society, in other countries, like France or Spain, it is particularly popular among the modern, cosmopolitan elite.”

Methodological information

The data used is based on the SINUS-Institut's own research, for which SINUS conducted online surveys with at least 1,000 people per country between October 2022 and May 2023. The results were weighted and are representative of the populations of the individual countries from 18 to 65 years of age.

About SINUS-Institut

SINUS Markt- und Sozialforschung GmbH, with offices in Heidelberg and Berlin, has specialised in psychological and social science research and consulting for over 40 years. SINUS develops strategies for companies and institutions that use socio-cultural change as a success factor.

A key tool is the Sinus-Milieus model - a model of society and target groups that summarises people according to their lifestyles in "groups of like-minded people". For decades, the Sinus-Milieus have been one of the best-known and most influential segmentation approaches in the German-speaking market and are available for over 48 countries.

SINUS cooperates closely with its sister companies INTEGRAL Markt- und Meinungsforschung in Vienna, Austria, and OPINION Market Research & Consulting, Nuremberg, Germany (INTEGRAL-SINUS-OPINION Group).

More information on SINUS-Institut at www.sinus-institut.de.

Press contact

SINUS Markt- und Sozialforschung GmbH

Tim Gensheimer

Phone: +49 (0)6221 – 80 89 – 60

Mail: presse@sinus-institut.de

About OPINION

OPINION is one of the leading market research institutes in Germany, utilising expertise in ad hoc and tracking studies to accompany more than 100 national and international brands. For more than 25 years, OPINION has been helping our clients understand what drives their consumers around the globe. Our focus here is particularly on the FMCG sector with all its facets. OPINION does not offer off-the-shelf market research, but draws upon a broad spectrum of methods to design custom approaches tailored to our clients' needs.

OPINION is a member of "The Research Alliance", a global network of independent market research institutes in Europe, USA, South America, the Middle East, Asia and Australia. This enables us to augment our trusted services with local expertise in each market worldwide, to the benefit of clients with a global presence or aspirations.

More information on OPINION at www.opinion.de

Press contact

OPINION Market Research & Consulting GmbH

Thomas Maurer

Phone: +49 (0)911 - 39 364 - 57

Mail: info@opinion.de